Consumer Research

What is my consumer? What do they like? Do they say one thing and mean another? From exploratory research to concept evaluations, our custom developed online research methods helps us understand consumers’ mind. We believe that a little bit of soul searching and a lot bit of market researching can answer most whys, whats, and hows of everyday life. Our suggestion – get more bang out for your research budget, conduct it online.

Zoom-in

with qualitative

research

-

Exploratory

If we knew where we’re going, we wouldn't call it exploration

Explorers seek to discover whereas the lost look to find. For brands venturing into a new market want to establish their own territory within a category, exploratory research serves as starting point. In sea like market, laden with high waves and depression exploratory research is the compass to guide a brand’s journey

Story of a brand in personal care

MandateDesign a communication strategy to enter and win the rural market segment

Objective- Develop a mind-map of a typical small town consumer – her beliefs, values, attitude, and lifestyle

- Decode grooming needs, key desires with respect grooming & relevance of a first pimple

- Triggers and barriers to the facewash category

Our ApproachSince our research objective were mutually exclusive and collectively exhaustive, we devised a two pronged approach to understand -

1. The consumer psyche – Comprehensive in-depth interviews were conducted in order to unveil context about the consumer’s grooming repertoire and media consumption habits

2. The dynamics of facewash category - With the end goal to decode the ecosystem of facewash category, group discussions with friends were setup. Additional filter of female friends provided a conducive environment to discussions, prompted young consumers to divulge much more, leading to a rich discussionResultOur research findings guided the client to choose the right influencer such as friends, and increase focus on motivation rather than on anxiety to design a clutter breaking communication strategy

-

Diagnostic

Shifting focus from symptoms to the underlying cause

Whether you are starting afresh, midway into building the brand or you are already established in the market – you tend have a rollercoaster ride and during your lows – we help you find the root cause of the problem that helps you get back on track

Story of a star media brand

MandateDiagnose reasons leading to constant fall in television rating points

Objective- Test hypothesis about change in brand perception, dig deeper into brand health

- Identify purchase triggers and barriers for the brand

Our ApproachTo gauge present brand health, we recommended doing interviews with two kinds of audience- married women of varied age bands and married women along with their mother-in-laws. The thought was to get an intergenerational-current perspective about the brand. Between the two audience, 3 user types were identified:

1. Users of the brand for more than 2-3 years -Both audiences

2. Recent Entrants (for current perspective on the brand and triggers to increase the viewing time)- Married women of varied age bands

3. Lapsers (for barriers that led to lowering the brand imagery)- Married women of varied age bandsResultResearch led us to conclude that constantly changing actors for certain characters, incomplete climax, halting a show midway, dropping important anchor-characters were stand-out brand barriers. These helped the brand to better plan show launches and timelines

-

Concept Evaluation

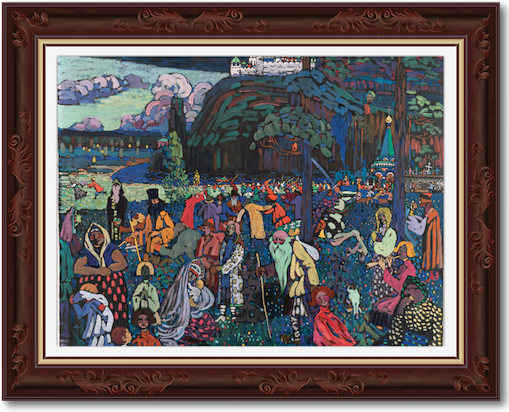

From rough sketch to a finished work of art

For brands that are already well established in the market, taking a risk becomes slightly difficult as new product offerings need to be in sync with the original brands proposition. In such situations, risks can be avoided if the idea is first tested amongst a small audience and then released into the market

Story of a personal & home care brand

MandateEvaluate the fitness of a new idea; choose a winner concept amongst plausible concepts

Objective- Determine growth aspects of an idea within a category

- Identify refinement cues to increase the engagement level with the audience

Evaluating concepts requires rich data to gain a wholesome understanding. Group discussions were chosen as the go-to research instrument to dig insights. Regular users of the category were chosen, usage of pre-defined competition brands was a pre-requisite. Learnings from five group discussions helped us chart a comprehensive map of user likes and dislikes, which further aided in weighing all the ad-concepts.

ResultResearch insights aided the client to choose one, out of all plausible ad-concepts, as the winner. The idea was further refined before finally airing it.

-

User Journey

If you have to walk a mile in someone else’s shoe, design your journey well

Since our hunter gatherer days, humans have researched well, weighed pros cons before embarking on journeys looking for food water and shelter. Since the days of Vasco da Gama, designers know that a well researched journey design can lead to unexplored routes

Story of a famous Swedish DIY furniture retailer

MandateBefore launching a city, the brand wanted to understand the city’s shopping culture. Clearly identify drivers of choice and intent of store visit

Objective- Understand needs, wants, desires with respect to furniture as a category

- Test concept of a store in the metro market

- Identify user profiles

Our ApproachScope of the problem required us to use a hybrid plan of research– Quantitative and Qualitative.

• Quantitative methods helped us to make shopper profiles, and understand frequency of visits and reasons for visits

• Through qualitative methods we focused on understanding existing need gaps. These insights were moulded into consumer journeys which helped in designing in-store experience

• To test the concept of a store, measurable parameters were defined - likeability, relevance, uniqueness, and brand connectResultCategory-wise insights helped the brand to design shopping experience. These insights also guided the brand to divide SKU availability –online, office, or both. The brand first launched its online store in the city, and is gearing up to launch a offline store now

Zoom-out

with quantitative

research

-

Brand Health

If one part of branding is (story) telling, then the other is listening

In research, listening is analogous to measuring. We approach each branding effort as a perpetual dialogue, two-way communication between the brand and its consumer, rather than a monologue. We help our clients tell brand stories and listen to the audience responses

Story of the world’s largest retailer

MandateAt a time when e-commerce retail space is beginning to clutter, the client wanted to establish a clear visual identity, in an effort to build brand character

Objective- To cut through clutter and develop brand recall, develop a quick brand guidebook, as a foundation to future brand guidelines

- As a POC, develop an A/B testing strategy to test new guidelines

Our ApproachIn this customised approach, we sought Aristotle’s approach to brand character. We studied brand ethos (ethical appeal), pathos (empathetic appeal), and logos (logical appeal). These formed our base to develop a first draft of brand guidelines to be used for A/B testing. To focus our efforts and minimise implementation time, we first chose one channel of communication – display ads, as a proof of concept. In accordance with brand guidelines, new creatives were ran across display network.

OfferingsStandard Practices

No frills approach relies on approaches which have stood the test of time - Brand Tracking

- Ad Effectiveness

- Loyalty Measurement

- Positioning Research

Customised Solutions

Since one shoe does not fit all, we encourage brands to deploy a customized approach to brand health measurement. Digital or offline, mono-channel or hybrid, we help our client to tailor a plan of action best suited, specifically to them. Define and measure custom tracking parameters across slices of customer segmentation to set new thresholds of effectiveness. Monitor parameters through regular reports or/& carefully designed tracking dashboard

-

Pricing Research

Like expectations, pricing too high is as hurtful as pricing too low

If 4Ps of marketing ever had a pecking order, P for Pricing would unanimously influence business decisions the most. Prices are just numbers; any decision about numbers ought to be made on calculation and research, but intuition.

Story of a large e-commerce retailer

MandateIn an effort to maintain Everyday Low Pricing promise, pin-point on an optimum everyday pricing for the ever volatile perishables category, on a store-SKU-day level

Objective- Determine SKU prices to maximise profit, considering shelf life & competitive pricing for perishables like exotic flowers & fruits

- Fabricate a demand driven mathematical model for maximum supply chain efficiency

Our ApproachWe gathered historical sales data, mostly through POS data at a store-day-SKU level. This data helped us analyse the price-profit, which was further used to develop a mathematical model. Manually, for each category, a shelf life was hard coded and then optimum pricing predictions were made. This was further supplemented by and vetted against competitive pricing to arrive at the final model

ResultThe model thus developed, took in consideration, historical pricing, competitive pricing, supply schedule, inventory space, and shelf space to make informed decisions on everyday pricing.

-

Segmentation

One person’s meat is another person’s poison

In India, contradictions abound, because there are many Indias within India. A nuclear-capable state that still cannot build proper roads. It has eradicated smallpox but cannot stop infanticide. Brands are compelled to choose a profitable India amongst the many Indias that exist

Story of a food & beverage retailer

MandateIdentify existing segments of consumers, develop product offering to suit them. Also, identify potential new segments and tailor new offerings for them

Objective- Clearly label consumer segments, study their needs and expectations from a dine-in café offering

- Modify the food and beverage offerings on the menu, add new items if required

Our ApproachBased on value-volume analysis, high impact stores were chosen the brand. These stores were labelled as on outlet to brand culture and values. A comprehensive and detailed questionnaire, which also included certain hypothesis, was developed. Research exercise was conducted across identified stores for 30 days. Healthy mix of in-dept interviews (short and long) and likert scale based questions provided us enough dept and width in data for a rich analysis. Participant slices included, standard segmentations like age, gender and custom segments like family, couple, and/or store individual visits

ResultResearch findings prompted a modification in store menu which led to increased ticket size and number. Store layout also witnessed change to accommodate needs of various consumer segments that were identified

Product Management

Our methods to product management finds it roots, evidently, from our most basic philosophy – make simple. As much as we are focused on what your product should have, we also want to eliminated all unnecessary features that make the product un-simple. Like a glove, we fit perfectly between your business and technology teams. An acute understanding of technology + business management enables us to provide a unique and comprehensive product management experience

Know Users

with experience research

-

Experience Design

In design, function is more equal than aesthetics

Good communication is the foundation of good design. Whether we’re designing a regular lamp or a complex digital product, our guiding design principles remain constant – functional, honest, and only sufficient design, driven by research.

Story of a commercial vehicle aggregator

MandateDesign a comprehensive suite of digital products for light commercial vehicle aggregator, with operations in a tier-2 market, where & when, even WhatsApp struggled to penetrate

Objective- Understand the user segments

- Design applications to suit all user segments

- Establish and follow a brand language

Our ApproachWe designed a custom research plan, a two pronged approach where consumer research & app development worked together Research: Regular depth interviews with systematically sampled customers as well as on-field sales team gave us real time feedback. Weekly ‘chai pe charcha’, group discussions further aided us to understand brand perception Development: For app development, we constantly worked alongside the in-house tech team. Regular consumer feedback helped us marry business and tech needs, while also simultaneously shape the product and nurture a brand language

ResultA customer side app, a driver side app, and a web control platform was developed which helped our client to scale their business from 0 to 1 Newly established brand identity aided our client for all marketing communications like press releases, app notifications, and all digital advertising content. Have a look - Click here to view

-

Feature Development

Eliminate unnecessary features > include necessary features

Somewhat old school, we belong to the days of easy-to-use, easy-to-understand products, when a product manual was included but wasn’t necessary, in contrast to present day, where no manual is included, but is often necessary.

Story of the world’s largest retailer

MandateDesign a merchandise planning tool which should be able to seamlessly handle country level merchandising operations, but should also run on outdated Pentium processor computers

Objective- Develop an Excel based tool for merchandise planning

- Tool should be able to handle country level merchandise planning, end-to-end

- Should be easy enough to cater to users across corporate hierarchy

Our ApproachAt the conclusion of a thorough brain storming, our first principles based approach led our focus to two features, in order of priority:

1. Exclude any product features that did not directly contribute to the core purpose of the feature

2. Make the tool comprehensive but as fluid and easy to navigate

Through back-end VBA programming, our team customised an excel worked into a live working tool for in-store merchandise planning. The tool could predict sales (including seasonality), as well as helped in planning merchandise from store-district level ResultDeveloped a multi-functional Access-powered Excel VBA framework, to plan merchandise at all business levels, currently being used by the entire Brazil market The tool was able to efficiently plan bulk buying, it helped save $3mn monthly

New Products

Much like a serendipity, we realized that our research oriented way of thinking ensures that there’s never a dearth of new ideas. Although it is a bitter-sweet dilemma to choose from these ideas, we cherry pick those which we believe will compliment our strengths as well will find purchase in the market. Industry agnostic, we research, design, & develop digital products. Have an idea? Talk to us.

Design

with research-

Smart Athlete

Eliminate unnecessary features > include necessary features

Somewhat old school, we belong to the days of easy-to-use, easy-to-understand products, when a product manual was included but wasn’t necessary, in contrast to present day, where no manual is included, but is often necessary.

Story of an IOT assisted, self-sufficient athlete

MandateDesign a merchandise planning tool which should be able to seamlessly handle country level merchandising operations, but should also run on outdated Pentium processor computers

Objective- Develop an Excel based tool for merchandise planning

- Tool should be able to handle country level merchandise planning, end-to-end

- Should be easy enough to cater to users across corporate hierarchy

Our ApproachAt the conclusion of a thorough brain storming, our first principles based approach led our focus to two features, in order of priority:

1. Exclude any product features that did not directly contribute to the core purpose of the feature

2. Make the tool comprehensive but as fluid and easy to navigate

Through back-end VBA programming, our team customised an excel worked into a live working tool for in-store merchandise planning. The tool could predict sales (including seasonality), as well as helped in planning merchandise from store-district level ResultDeveloped a multi-functional Access-powered Excel VBA framework, to plan merchandise at all business levels, currently being used by the entire Brazil market The tool was able to efficiently plan bulk buying, it helped save $3mn monthly